Getting organized early puts you in a stronger position to avoid penalties, interest, and last-minute stress before the April 15 deadline. Here’s a tax preparation checklist to help you stay organized, collect the necessary documents, and prepare your tax information accurately.

- Gather and organize income documentation, personal information, and tax records. The IRS publishes an annual Get Ready campaign, offering important updates, helpful reminders, and tips to prepare for the upcoming filing season. Keeping your tax records organized not only helps ensure accurate and complete returns but also reduces the risk of errors that could delay refunds.

W-2s, 1099s, and other tax forms start arriving early in the year. Don’t let them get buried in a drawer. Set up a dedicated folder, either physical or digital, to keep all your tax-related documents organized as they come in. Additionally, be sure to include other essential items such as Social Security numbers, bank account information, other income statements, health insurance information, and last year’s tax return for reference.

- Understand key tax law changes. While you are working on gathering everything to file your 2025 tax return, now is also the time to plan for 2026 taxes. Several new provisions in the One Big Beautiful Bill Act (OBBBA) will affect planning. For example, for tax year 2025 (return filed in 2026), the OBBB raised the standard deduction amount to $31,500 for married couples filing jointly. For single taxpayers and married individuals filing separately, the standard deduction for 2025 is $15,750, and for heads of households, the standard deduction is $23,625. For 2026, the standard deduction amounts are even higher: $32,200, $16,100 and $24,150 respectively. Understanding these updated deduction amounts now is important because they directly affect how much income is taxable on the return you’re about to file and can help you decide whether or not it is worth it to itemize.

- Review your withholdings and estimated payments early. Now is a great time to take a quick look at your W-4 withholdings or your estimated tax payments. Doing this early can help you spread your tax obligations more evenly over the year and possibly reduce the risk of underpayment penalties. Even if last year you got a large refund or ended up owing money, reviewing your situation now can help prevent surprises and make your tax year more manageable.

- Track your deductions and credits and maximize retirement and HSA contributions. Start tracking your tax deductions now to stay organized and make filing easier. Home office expenses, charitable donations, education costs, and child and dependent care credits all require documentation you don’t want to hunt down later. Additionally, starting your IRA, 401(k), or HSA contributions now may help reduce taxable income and give your investments more time to grow.

- Consider professional help to avoid filing mistakes. If your tax situation is complex, consider consulting a tax professional for guidance. Most audits happen because of simple mistakes, like missing forms, mismatched income, wrong Social Security numbers, or filing before you have everything you need. That’s why it’s important to work with a financial professional who can help you avoid these errors, keep your records organized, and make sure you are taking full advantage of available deductions.

Make tax season less stressful. Contact us today to review your financial and retirement plan and discuss personalized strategies. You can reach The Financial Education Group by calling (360) 900-3837 or setting up an appointment with us here.

This article is for general information purposes only from sources believed to be accurate. It should not be construed as tax advice. In every case, you should consult with your own personal team of tax, financial, and legal advisors for tax advice specific to your own personal financial situation.

Sources:

https://www.irs.gov/individuals/get-ready-to-file-your-taxes

https://www.aol.com/articles/head-start-2026-tax-return-160512082.html

https://www.irs.gov/newsroom/what-taxpayers-can-do-to-get-ready-for-the-2026-tax-filing-season

https://www.irs.gov/newsroom/one-big-beautiful-bill-provisions

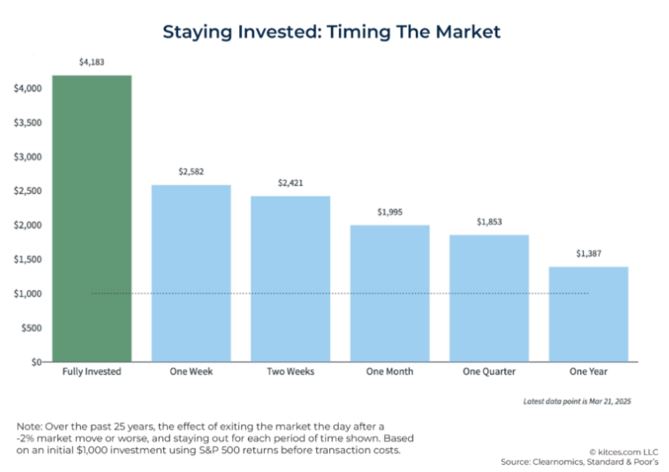

This chart shows that those who exit the market the day after every -2% market move or worse over a 25-year time period usually underperform those who remain fully invested. When you leave the market, you don’t just avoid future bad days, you also miss out on the future good days. Ultimately, missing even just a few of the market’s best days, or getting back into the market only after the market is already up, can significantly impact long-term returns. Because, remember, just like in life, nothing stays bad forever; good days will come again. The market is no different.

This chart shows that those who exit the market the day after every -2% market move or worse over a 25-year time period usually underperform those who remain fully invested. When you leave the market, you don’t just avoid future bad days, you also miss out on the future good days. Ultimately, missing even just a few of the market’s best days, or getting back into the market only after the market is already up, can significantly impact long-term returns. Because, remember, just like in life, nothing stays bad forever; good days will come again. The market is no different.