In the past, annuities have been a topic avoided by many, but lately interest levels have risen—a lot. In fact, online searches for terms like “annuities” and “pensions” are up by 160% while “are annuities good or bad” are up by 200%, according to ThinkAdvisor.

With retirement lasting longer and retirees worried about recent market volatility, tariff uncertainty, potential Social Security cuts, and continued inflation, now may be a good time to learn more about annuities and the role they can play in the retirement portfolio. And since June is Annuity Awareness Month, we decided to open up the conversation and provide some clarity.

To start, whether you’re planning for retirement, getting close, or already in it, it’s important to have a retirement plan in place, and review it regularly. Having an account like a 401(k) doesn’t mean you have a retirement plan. Too often, people put away money in a tax-deferred 401(k) or similar plan and don’t think about how they will create a stream of income from it once they are no longer getting a paycheck.

As you get closer to retirement, it’s important to reconsider how much of your savings are exposed to the ups and downs of a volatile stock market. This is especially true because of “sequence of returns risk.” Breaking this risk down, if you retire during a stock market downturn and begin withdrawing money from your 401(k) for income, your savings can shrink much faster over time compared to someone who retires and withdraws income when the market is doing well. And since no one can actually predict the future, it’s best to leverage several strategies in your retirement plan.

An annuity is a contract between an individual and an insurance company designed to provide a monthly stipend or income during retirement. There are many different types of annuities, and some have different fee structures and contract terms which may, or may not, be better in your case. That’s why it is best to work with an independent financial advisor who has access to many different types of annuities from multiple highly-rated insurance companies to compare between.

Some annuities, like lifetime fixed indexed annuities, even provide retirement income that won’t run out no matter how long you live, guaranteed by the financial strength and claims-paying ability of your insurance company providing the annuity policy. And some even have contract provisions to address inflation.

Annuities can be appealing because they allow you to take part of your retirement nest egg and purchase monthly retirement income in the form of an annuity, so you don’t have to worry about managing withdrawals aside from required minimum distributions (RMDs).

With your income accounted for, the rest of your portfolio can be accessed or left in the market, depending on future need and economic conditions.

A recent study by David Blanchett and Michael Finke found that many retirees prefer the security of guaranteed lifetime income rather than dipping into their savings or 401(k), even when they could afford to. It can be hard to think of your savings as a source of retirement income, which is why working with a retirement advisor to create a real retirement plan can help give you confidence in your financial future.

Every day, about 10,000 people turn 65 in America, and annuities may be indicated for a portion of the fixed part of their portfolios depending on their situation. Times have changed, and it’s no longer just about the ratio of stocks to bonds. Research done by academic heavyweights in economics and finance in the last 10 years indicates that annuities can help. Roger Ibbotson, Robert Shiller, and Wade D. Pfau have shown that fixed indexed annuities, when used correctly, can improve retirement outcomes compared to using bonds, with annuities helping to address longevity and market risk in the fixed portion of the typical retirement portfolio.

In today’s interest rate environment, some fixed indexed annuities even offer bonuses that can help boost your annuity’s value. Additional features such as optional coverage for long-term care, terminal illness, or spousal income can also be included, making annuities customizable.

With so many choices, it’s important to remember that every person’s situation is unique, meaning annuities may or may not be indicated depending on your specific needs and goals. That’s why we’re here to help you explore your options, explain how different annuities work, and create a long-term retirement plan. If you’d like to discuss how annuities might fit into your retirement strategy, give us a call! You can reach The Financial Education Group by calling (360) 900-3837 or setting up an appointment with us here.

Sources:

https://www.thinkadvisor.com/2025/04/15/6-reasons-annuity-is-no-longer-a-dirty-word/

https://401kspecialistmag.com/retirees-prefer-spending-lifetime-income-over-savings/

https://www.kiplinger.com/retirement/annuities-what-you-dont-know-can-hurt-you

https://www.protectedincome.org/wp-content/uploads/2023/06/RP-20_Pfau_final.pdf

https://thequantum.com/a-closer-look-at-bonds-versus-fixed-indexed-annuities/

https://safemoney.com/blog/annuity/shaquille-oneals-strategy-why-annuities-are-essential/

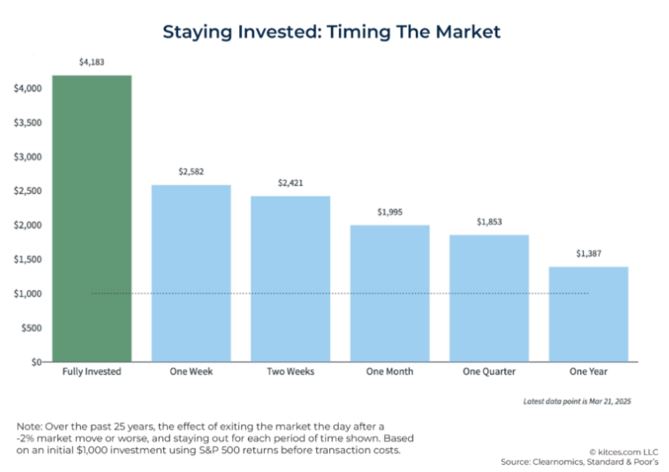

This chart shows that those who exit the market the day after every -2% market move or worse over a 25-year time period usually underperform those who remain fully invested. When you leave the market, you don’t just avoid future bad days, you also miss out on the future good days. Ultimately, missing even just a few of the market’s best days, or getting back into the market only after the market is already up, can significantly impact long-term returns. Because, remember, just like in life, nothing stays bad forever; good days will come again. The market is no different.

This chart shows that those who exit the market the day after every -2% market move or worse over a 25-year time period usually underperform those who remain fully invested. When you leave the market, you don’t just avoid future bad days, you also miss out on the future good days. Ultimately, missing even just a few of the market’s best days, or getting back into the market only after the market is already up, can significantly impact long-term returns. Because, remember, just like in life, nothing stays bad forever; good days will come again. The market is no different.